Finances can offer clues to cognitive problems

A study found that patients with Alzheimer's disease and related dementias were more likely to miss payments on credit accounts as early as six years before diagnosis and to develop subprime credit scores 2.5 years before diagnosis.

Signs of Alzheimer's disease and related dementias may show up years before diagnosis in a potentially unexpected place: patients' finances.

Researchers performed a retrospective data analysis that linked consumer credit report outcomes from 1999 to 2018 to Medicare claims data among 81,364 Medicare beneficiaries. They compared adverse financial events, defined as missed payments on credit accounts and subprime credit scores, in patients with a diagnosis of Alzheimer's disease or related dementias versus those without. The study also examined the timing between the adverse financial events and a dementia diagnosis.

“You'll see in the lay press stories of people who've been devastated, with huge financial losses, due to undiagnosed dementia, but very little to no research about the magnitude of that effect and how often it happens,” said study author and ACP Member Julie P.W. Bynum, MD, MPH. “This was really, I think, one of the first studies of its kind to say, ‘OK, we've heard the anecdotes. What does this look like in the population? Is this a real problem?’”

In the study, which was published in the February 2021 JAMA Internal Medicine, Dr. Bynum and her coauthors found that patients diagnosed with Alzheimer's disease and related dementias were more likely to miss payments on credit accounts as early as six years before diagnosis and to develop subprime credit scores 2.5 years before diagnosis. In addition, these patterns were unique for dementias versus other medical conditions, including arthritis, glaucoma, myocardial infarction, and hip fracture.

Dr. Bynum, who is the Margaret Terpenning Professor of Medicine in the Division of Geriatric Medicine at Michigan Medicine in Ann Arbor, recently spoke to ACP Internist about the findings.

Q: Were the study results what you expected?

A: I've been a clinical provider to people with dementia, so it was definitely what I expected to see. But I must say the magnitude and the length of time before a diagnosis, almost seven years, that these problems started occurring surprised me. It's a pretty clear finding in these data; it's not ambiguous. There's little to no effect with the other disease scenarios we looked at, but a very clear finding for people who develop dementia.

Q: Do physicians typically screen for financial problems in their patients?

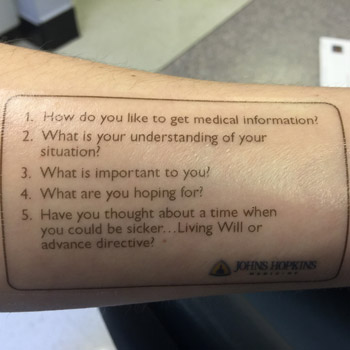

A: If you're a geriatrician, there is a standard question to ask—something like “How are you doing managing your finances?” For most physicians, though, that's not front and center. That's not what we're thinking about. We're taking care of patients and thinking about their health management. “How are you managing your medications? How are you getting around?” Those are common questions, whereas something like “Are you missing payments on your bills?” isn't often asked.

If you're worried somebody might have diabetes, you ask, “Are you having frequent urination? Excessive thirst?” Well, if you're seeing an older person, you should ask, “Are you having any trouble managing your finances?” Maybe that's not a physical symptom, but it could be a symptom that there's something going on in the cognitive realm. When we hear there's financial troubles, that might need to be a trigger for a physician to think, “Oh, now I really need to do a Mini-Mental State Exam or a MoCA [Montreal Cognitive Assessment].” It sounds sort of intuitive, but I don't know that we do it.

Q: The study found that financial difficulties were more common among patients living in areas with less formal education. Can that be considered a risk factor?

A: It's a really complicated relationship, and this is observational data, so we can't say it's causal. But there are a lot of things about being in a low-education, low-income area that travel together, such as low education, low financial literacy, and also fewer resources with less margin for financial error. All of those things contribute, and there were probably also additional risks for cognitive impairment, or decline that goes with it, so it's pretty tangled up. But it is true that people in under-resourced communities seem to show the financial toxicities more so than people who reside in wealthier areas. That could also just mean [the latter] have more social supports, more guardrails, around them.

The other thing to recognize is that this study is using these administrative data to identify who has a diagnosis of dementia. In the health care system, the people who have been diagnosed are often already quite far along in the disease. The people we're identifying in this study have moderate to severe disease. We tend to see the Alzheimer's and dementia diagnoses come up in the claims data in the last three years of life, but really dementia has at least a 10-year disease course. So it could be that financial troubles are a marker of early disease that we just haven't diagnosed yet in clinic. More than likely these are undiagnosed people in the community who are showing these signs.

I don't want people to interpret the study as saying financial problems are a risk factor for getting dementia. This is a signal, because the literature says that 50% of people with this disease are undiagnosed at any point in time. This isn't screening; this is case finding. When people are having financial issues, we should be doing case finding: Is there a cognitive issue contributing to their financial problems?

Q: What are some other ways these problems could be detected earlier?

A: The crux of the issue is how do the finance industry and the health care industry connect for the protection and identification of these people. These are vulnerable people in our community, and we in both industries have privacy protections, so how do we untie this knot to be able to get these people some protections? The finance community is also concerned about this and also looking for solutions. That may eventually mean that this moves into some sort of regulatory framework, covering who has the permission to protect people and bring things forward and who has reporting responsibilities.

Q: The editorial that accompanied your study mentioned using artificial intelligence (AI) as a way to find financial problems. Do you think that could be helpful?

A: Where AI comes in, I think, is not on the health care side. Where AI can come in is on the banking side or on the credit side. If they were applying well-developed AI algorithms, they might be able to identify people whose behavior appears to change such that a red flag should go up on their account. They certainly have enough data to be using AI in this way. But again, it would happen on the banking side or the finance side, in which case we would still need the connection to the health care side to activate a medical evaluation.

Q: What are some take-home messages from your study for primary care physicians?

A: Primary care is where people living with dementia are identified, and primary care physicians are really the backbone of what this community of vulnerable patients needs. In the review of systems for older adults, including something about how well they're managing their finances might be something primary care physicians really want to add as a marker for someone whose cognitive status should be tested.

We ask about subjective memory complaints, but this is another question we can add to our armamentarium that might capture people who may not admit or may not have insight into their cognitive problem, or who may be having another executive functioning problem. Including this question of “How are you doing with managing your finances? Any trouble?” can give us one more place to reduce underdiagnosis of this disease.